What you can do to have enough to live on when you retire from your employer

It’s important to understand your retirement fund and your employer’s fund benefits

Your member booklet or benefit schedule has the details of the benefits and options that are specific to your employer or fund, including the following information:

- Available investment portfolios

- Percentages you can choose from to save for retirement every month (contribution rates)

- Available insurance benefits

- How to increase the amount you’re saving towards retirement or how to add to your retirement

You can get your member booklet from your human resources department.

Important things you can do today to improve your financial health

READ

to find out more about the importance of having a will and keeping your beneficiary nomination form updated.

WATCH

this video about the importance of balancing your needs now with your future goals and getting the right support to help you do this.

LISTEN

to charting course to financial freedom on Classic Business with Michael Avery.

READ

help your child learn the value of saving, planning and spending wisely through fun, interactive stories in Smart Money Moves for the Save Squad.

Other useful information about your retirement fund

-

What’s a retirement fund?

When you’re no longer earning a salary at the end of your working life, you can use your savings in your retirement fund to buy a pension that will give you regular income. Your employer has provided you with a provident or pension fund.

How does a retirement fund work?

-

Every month, you, your employer or both make contributions to your fund.

-

One-third goes into a savings pot and the other two-thirds goes into a retirement pot. This is called the two-pot system.

-

You can withdraw from your savings pot once in a tax year (1 March to 28 February). Your retirement pot must, by law, be preserved until you retire.

-

You can use your retirement savings to buy a pension that will give you a regular income in retirement.

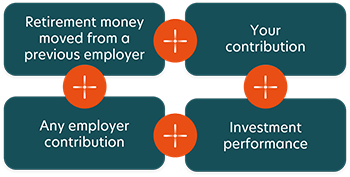

How much your pension will be depends on:

-

how much you or your employer contribute during your working life

-

how investments have performed

-

whether you keep your retirement savings invested instead of taking them in cash when you change jobs

-

the cost of buying a pension when you retire

-

-

What is a benefit statement?

A benefit statement shows:

-

how much you’ve saved in your savings pot and your retirement pot so far

-

the pension you can expect based on the information we have about you

Here’s an explanation of your benefit statement.

View your benefit statement by registering on AF Connect. Your benefit statement will tell you how much you’ve saved and which portfolios your savings are invested in. You can also download the AF app on the Apple App Store or the Google Play Store.

-

-

Can I add extra money to my retirement savings?

The rules of your fund will tell you if you can make extra contributions to your retirement savings in addition to your monthly contributions. These are called ‘additional voluntary contributions’. It is very important to contribute as much as you can every month.

-

Is there a specific amount I must pay towards my retirement savings?

You can choose a contribution amount from the options that are provided in the rules of your fund. It is very important to contribute as much as you can every month. You can find out more about your contribution options in your member booklet (which you can get from your HR department).

-

Can I increase the amount I’m saving towards retirement?

If your fund offers more than one contribution option, then you can usually change the amount you are contributing to retirement once a year or more often, depending on your retirement fund rules. You can ask your HR department more about this option. Contributing more will give you a better chance of having enough to live on when you retire from your employer.

-

Is there a specific amount I must pay towards my retirement savings?

You can choose a contribution amount from the options that are provided in the rules of your fund. It is very important to contribute as much as you can every month. You can find out more about your contribution options in your member booklet (which you can get from your HR department).

-

How much does my employer pay?

Your employer might contribute an amount based on your pensionable salary, depending on the rules of your fund. Your pensionable salary (or fund salary) is the part of your salary that your retirement savings contributions are based on.

-

Do I pay any fees?

Yes. The costs of running and administering the retirement fund are taken from contributions. You can find the details of these costs in your member booklet.

-

How does the performance of my retirement fund’s investment portfolios affect my retirement savings?

If you’re a member of a defined benefit fund, investment performance doesn’t directly affect your retirement fund savings.

Most members belong to defined contribution funds. In a defined contribution fund, the value of investments in your retirement fund’s investment portfolios do affect your retirement savings.

Find out which type of fund you belong to by asking your HR representative or logging onto our website to check your statement.

There are two main things that affect the value of an investment portfolio:

-

Conditions in investment markets

-

Over shorter periods of time – days, weeks, months and sometimes even years, investments can decrease in value. Sometimes different types of investments all decrease in value at the same time.

-

Over longer periods of time, we expect the investments in your retirement savings portfolio to increase in value.

-

-

How well the investment managers do

-

Alexforbes Investments chooses the investment managers that manage the money in your investment portfolio.

-

We choose the investment managers very carefully to make sure that they manage the money in retirement savings portfolios responsibly and professionally. We monitor these investment managers on an ongoing basis.

-

We also choose a mix of managers who we think will give your retirement portfolios the best chance of growing more than other portfolios.

-

Over shorter periods of time, retirement savings portfolios may not do as well as other portfolios. This is because we choose and mix investment managers based on what we believe, based on our research, will be best over longer periods of time.

-

-

-

What is the difference between single and multi-managers?

-

A single investment manager is a manager of investments (asset classes).

-

A multi-manager is a manager of investment managers.

Multi-managers don’t actually buy and sell asset classes, but rather manage the investment managers, who do this on their behalf. Ultimately, multi-managers blend the best assets to give the most appropriate investment management solution. To achieve this they:

-

Assess a fund’s investment needs.

-

Match these investment needs with a combination of single managers to meet them.

-

Monitor the investment managers to make sure they deliver the required performance.

A good multi-manager combines the services of selected single managers based on their proven ability in individual areas of expertise, depending on the fund’s particular investment requirements.

-

-

Am I saving enough?

Knowing if you’re on track is an important first step to reaching your goals. Use our fun gamified tool to build your retirement picture and find out if you’re on track and what you can do if you’re not on track.

-

How much tax will I have to pay if I withdraw some or all of my retirement savings in cash when I change jobs?

With the new two-pot system, you can withdraw cash from your savings pot once in every tax year (1 March to 28 February). If you’ve made a withdrawal from your savings pot during the tax year, you won’t be allowed to make another cash withdrawal from your savings pot when you leave your employer. Although, if you have a small amount in your savings pot, you may be allowed to withdraw it. Withdrawing from your savings pot is taxed at your marginal tax rate – the same rate of tax you pay on your salary.

If you decide to withdraw, rather than preserve your retirement savings, this is how you’ll be taxed: During your lifetime, you can take a total of R550 000 of your retirement savings tax free on retirement. However, all amounts you withdraw in cash (exceeding R27 500) before retirement will reduce this amount. How much you are taxed depends on how much you take and when you take it.

SARS sets the amount of tax you pay on any amount you withdraw. This can change from time to time. The latest information is available on SARS’ website. A financial adviser can help you work out how much tax you may need to pay if you plan on withdrawing any of your retirement savings in cash when you leave your job.

-

What happens to my retirement savings if I am retrenched?

If you decide to withdraw any of your retirement savings in cash if you are retrenched, you may have to pay tax. SARS sets the amount of tax you pay on any amount you withdraw, depending on how your employer has classified your retrenchment. The rate of tax you must pay changes from time to time. This information is available on SARS’ website. A financial adviser can help you work out how much tax you may need to pay if you plan on withdrawing any of your retirement savings in cash when you have been retrenched.

It is especially important to have the support of a financial adviser if you have been retrenched, especially if you don’t find another job straight away or think you’ll struggle to cope financially. A financial adviser can help you make the most of what you have and try to keep as much of your retirement savings invested for your future self at the same time.

-

What happens to my retirement savings if I don’t make a decision when I leave my employer?

Your retirement savings in both your savings pot and your retirement pot will stay invested so that they can carry on growing.

It is very important for you to keep your contact and other details up to date with Alexforbes so that you can keep receiving information about your retirement savings.

Please get in touch with the Client Contact Centre to update your details.

-

How long before I retire should I start preparing for retirement?

If you’re closer to retirement, make contact with a financial adviser as soon as you can. We recommend that you start discussing your retirement plans with a financial adviser at least five years before your fund's normal retirement date.

-

Can I retire early if I’m too sick to continue working?

You can retire early on the grounds of ill-health, if you:

-

become too sick to carry on working

AND -

have not reached the fund’s normal retirement date BUT don’t qualify for a disability benefit

AND -

are totally and permanently unable to do your job

The benefit you get will be the value of your retirement savings in the fund.

-

-

Can I keep working at my company after I reach the fund’s normal retirement date?

The age you must retire is determined by the rules of your retirement fund. However, if you don’t need to start receiving a pension right away (for example, if you are able to continue working on a contract basis), you can keep your retirement savings invested in the fund until you’re ready to buy a pension. This is called delaying or deferring retirement. Your financial adviser can explain which of your retirement fund benefits will stop if you choose this option. Find out more about delaying retirement here.

-

How much do financial advisers charge and how are they usually paid?

A financial adviser can help you to make a financial decision that is right for you based on your individual circumstances. Financial advisers charge fees that are based on the financial products they help you select. For example, if a financial adviser helps you to use your retirement savings to buy a flexible pension or a guaranteed pension, you will be charged a fee.

Fees can be charged up front when you buy a pension and on an ongoing basis if you choose to receive ongoing advice. The up-front fee a financial adviser charges is limited to 1.5% + Vat of the amount you use to buy a pension, but the actual amount is negotiated between you and your financial adviser. The fees are usually deducted from the amount you use to buy a pension.

Please contact our My Money Matters Centre, where you can receive retirement benefit counselling and advice from our qualified financial consultants.

-

How long will it take after I retire to start receiving my money?

After retiring, you may experience a delay in receiving income for the first month due to administrative processes. This is because administrators wait until your last fund contribution is received and invested.

This is where the money in your savings pot comes in very handy. You can withdraw the money you need a few months before your retirement date. Otherwise, financial advisers suggest setting aside your leave payout, or using a credit card. It’s also good to notify creditors of potential delays in payments because if you don’t have savings, the process can take six to eight weeks.

It’s a good idea to start the process at least three months before you retire.

-

Can my retirement savings be divided between flexible and guaranteed pensions? Are there investment fees on a pension?

Your retirement savings can be divided between flexible pensions (living annuities) and guaranteed pensions (life annuities). There may be up-front and ongoing fees but the amounts will differ depending on the type of pension you choose and what is agreed on by you and your financial adviser.

In the case of a flexible pension, there will be investment fees on your investment portfolios. Investment portfolio fees are deducted from the value of your investments and won’t be shown separately on your statements. An administration fee is also charged for the administration involved to pay your pension to you and for preparing and submitting your tax information.